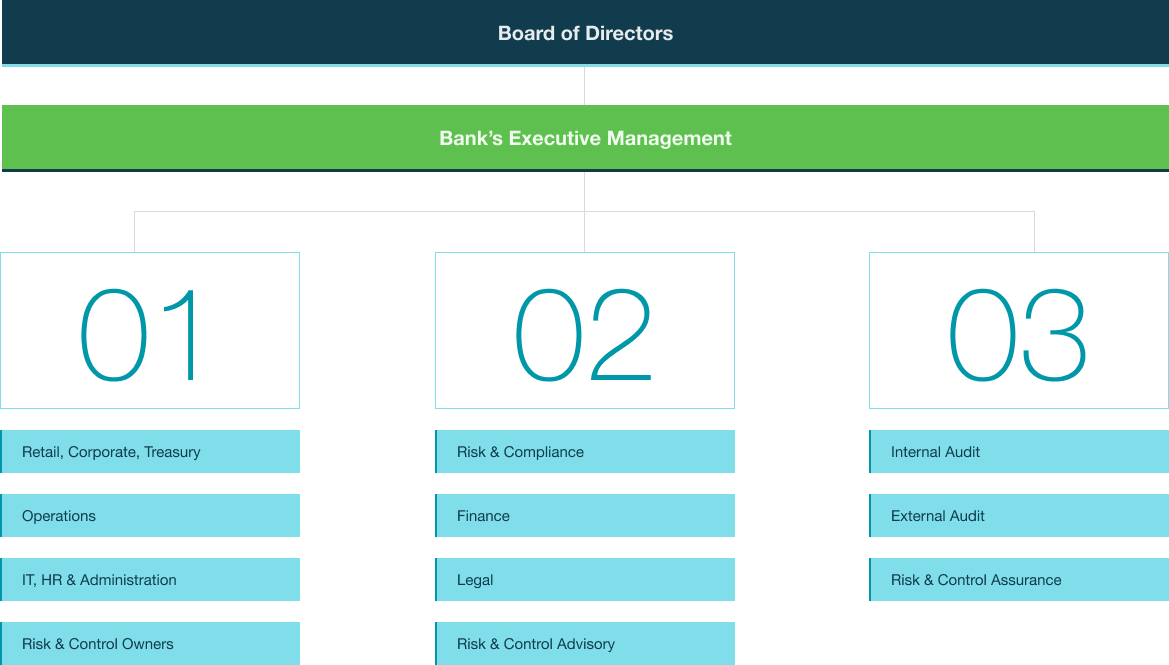

Risk Management Framework

Risk Management Model

First Line of Defence

01First Line of Defence

Within the Risk Governance structure, the First Line of Defence (also referred to as the "front line") includes relationship managers and other customer-facing employees and support units who are closest to the customers and counterparties during the contracting phase of relationships and conduct of transactions or business. The Line of Business Teams (Retail, Corporate or Treasury) that wish to conduct Banking Business with customers are also referred to as Risk Owners. The Operational Teams (Centre and Branches), Support Teams (HR, Finance, Admin) & IT Teams (Systems and Telecom) involved in supporting the Lines of Business to conduct their Banking also considered part of the First Line of Defence. These teams are also referred to as Control Owners

Second Line of Defence

02Second Line of Defence

The Risk & Compliance Function comprise the Second Line of Defence within the Risk Governance structure. The Head of Risk and Compliance ensures ongoing monitoring and to enable escalation or redressed of identified issues.

The Second-line Defence periodically reviews the

effectiveness of controls used to mitigate all types of Financial Crime and Operational Risks and provides information, guidance to the First Line; andinvestigates possible non-compliance with any Internal Policies & Regulations.

In general, the Second line exists to ensure that CDD Internal Processes and Procedures applied by the First Line are designed properly, Staff well trained, processes firmly established, and applied as intended.

They are also known as Risk & Control Stewards

Thrid Line of Defence

03Thrid Line of Defence

The Third-Line of Defence within the governance structure of the Risk Management Framework is the internal audit team, which undertakes independent reviews of the controls applied by the first two lines of defence. They are defined as Risk & Control Assurance

It independently evaluates the Risk Management and Controls of the bank through periodic assessments, including the adequacy of the AGD Bank’s controls to mitigate the identified risks.It also evaluates:

‣ the effectiveness of the staff’s execution of the controls