Corporate Governance Model

AGD Bank’s Board of

Directors

AGD Bank’s Executive

Management Team

AGD Bank’s Governance

Committees

AGD Bank’s

Policies & Procedures

Board of Directors

U Than Ye

Chairman

Mynmar

U Htoo Htet Yayza

Managing Director

Mynmar

U Wal Lynn Oo

Deputy Managing Director

Mynmar

Daw Ohnmar Swe

Director

Mynmar

Daw Thidar Swe

Director

Mynmar

Daw Shwe Shwe Lynn

Director

Mynmar

U Chan Nyein Zaw

Director

Mynmar

Daw Kay Thi Swe

Director

Mynmar

U Yin Htwe

Director

Mynmar

U Khin Win

Alternate Director

Mynmar

Bank’s Executive Management Team

David Stevenson

Finance

David Stevenson

Finance

David Stevenson

Finance

David Stevenson

Finance

David Stevenson

Finance

David Stevenson

Finance

David Stevenson

Finance

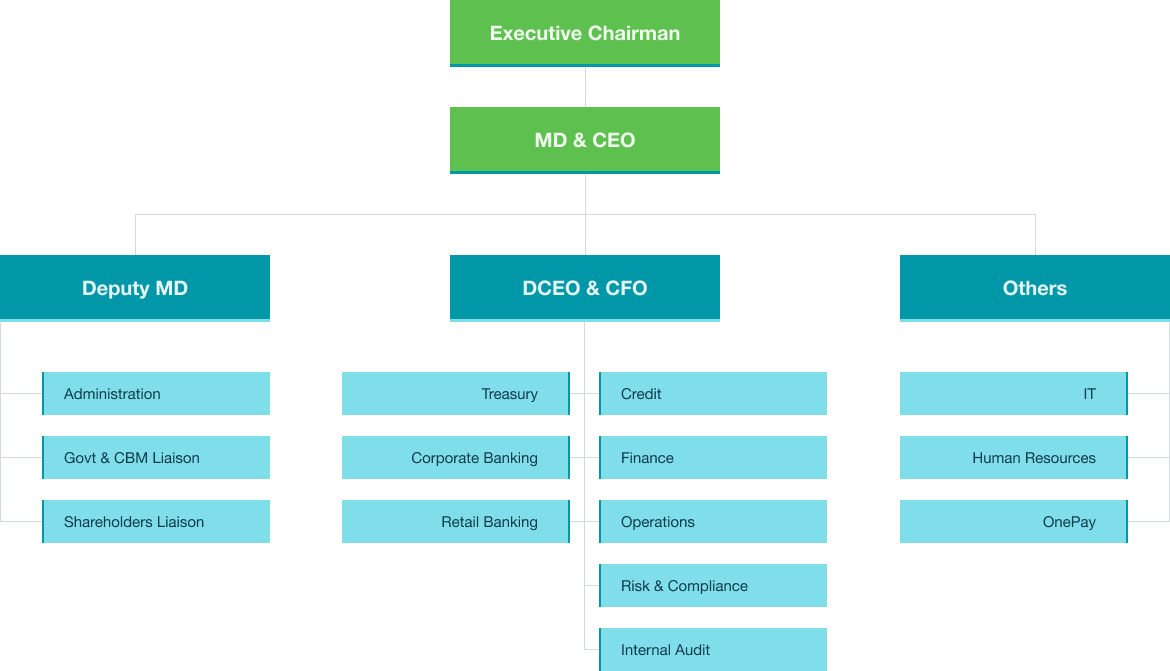

Organisation Structure

AGD Bank Governance Committees

Audit, Risk and Compliance Committee

01Audit, Risk and Compliance Committee

The ARCC oversees the governance of Operational, Financial Crime & Compliance Risks of the Bank and the efficiency of our Risk Management Policies and Procedures.

Assets & Liabilities Management Committee

02Assets & Liabilities Management Committee

The ALM Co oversees the governance of all Market, Foreign Exchange, Interest Rate and Liquidity Risks of the Bank.

Project Investment Committee

03Project Investment Committee

The PIC reviews and authorizes allOperational & Capital Expenditure of the Bank after reviewing pros & cons, alignment to our objectives & competing priorities

Credit Risk Committee

04Credit Risk Committee

The CRC reviews all Credit Proposals – Retail and Corporate to assess all facilities of their credit worthiness, pricing appropriate to the risk and in line with our lending guidelines.

Process & Systems Committee

05Process & Systems Committee

The PSC reviews all the Bank’s processes, forms and systems to ensure they are operationally efficient and mitigate all risks.

Special Assets Management Committee

06Special Assets Management Committee

The SAMC provides direction to effectively manage the collection of all non-Performing assets (NPA) of the Bank.